‘Old Wild Cat Times’: Frauds, Fake Towns, and Counterfeits in the era of Free Banking

The first years of Michigan’s statehood, starting in 1837, were full of wild speculation, inflated currency, counterfeits, and fraud. Poorly capitalized local banks, soon nicknamed “wildcats,” printed money without the ability, or sometimes intention, of ever allowing users to exchange it for proper specie – coins of gold or silver. Paper bills permeated the new state and beyond, but it was anyone's guess whether each individual bank was truly able to honor their redemptions.

Just two months into statehood Michigan passed its General Banking Law on March 15, 1837, which introduced “free banking.” Prior to its passing, a total of nine banks existed in Michigan. Each had been authorized by a separate act of the state legislature. In the first year of free banking that number doubled to 18. Two months after that, there were an estimated total of 40. By September of 1839, only nine remained. These two years of outrageous growth and rapid crash live in infamy.

Free banking allowed citizens to form banks without state or federal approval for the issuance of currency. Any group of twelve landowners could apply to county officials and stock in the association would be opened for subscription. In order for the bank to commence operations the stock had to reach $50,000. Ten percent of each share was supposed to be paid in specie upfront, and thirty percent of the entire capital stock was to be paid in “like funds.” The president and directors of the bank were required to provide a safety deposit to the auditor general of the state. This deposit, meant to be used to pay off any future debts, could include bonds and mortgages on real estate or bonds executed by resident landowners of the state, meaning personally secured bonds. This was where the law really went awry.

Real estate appraisals are fickle, based on market valuations that continuously change. This was especially true in an era of rapid Westward expansion which was predicated on the inflation of land value. As for personal bonds, a simple guarantee from an individual has clear flaws. To base a bank’s security on these estimates and promises was courting trouble.

Scio Sway

According to “History of Washtenaw County,” published in 1881, the genesis for the General Banking Law can be traced to back to right here in Washtenaw.

“In the year 1835 Samuel W. Foster and John Holden, of Scio, Washtenaw county, applied to the Bank of Michigan in Detroit, for a loan of money to buy wheat to stock their mill. The bank could not accommodate them but referred them to a broker doing business in the basement of the bank building, where they found money if they would submit to a “shave.” On their return home they conceived the plan on which the “wild-cat” banks were gotten up. Foster showed the plan, and a petition to the Legislature for the law under which the banks were created, to the writer. The bill passed with but few dissenting votes… The basis of the banks was a small per cent of the capital in specie and the redemption of the bills to be secured by mortgages in real estate.”

As this story demonstrates, there was a true need for more banks and the state legislature’s speed of approving them was not adequate to meet that demand. Businessmen like Foster and Holden desired loans to support and grow their business. The new law attempted to find a solution to aid in the nascent state’s growth, it just also introduced a plethora of new complications.

Local Liabilities

Ann Arbor’s first bank, The Bank of Washtenaw, was chartered by the state legislature before the onset of free banking. Citizens submitted a petition to the legislature and were approved in 1834. The bank opened in 1835 in the “old Chapin home” on the corner of Fourth Ave and Ann St. with capital stock of $100,000. It closed nine years later in 1846. Like many banks of the era, it had insufficient security for the amount of paper money circulated.

Under the looser free banking law of 1837 three banks opened in Ann Arbor: Citizens Bank of Michigan, Millers Bank of Washtenaw, and Bank of Ann Arbor (no relation to the one we know today). Partially organized under the General Banking Law was the Exchange Bank in Ann Arbor. Later, chartered by the state legislature in 1849, came the Government Stock Bank, which could be found in the same building that had been vacated by the Bank of Washtenaw. The intent of each of these banks is not fully known, but not all were duplicitous. The Millers’ Bank of Washtenaw was known to have been "conducted fairly, and paid all its indebtedness."

Tales & Tails

There are two main theories for the origin of the term “wildcat banking,” but there is little doubt that its use began as a means of describing these new Michigan banks.

It was in banks' best interest to issue paper currency at will, and against their interests to actually honor its exchange for specie. In order to discourage this, banks purportedly located themselves in remote areas surrounded by wilderness, forcing people to make arduous journeys to convert their cash into precious metal. One supposed obstacle the would-be redeemers encountered was actual wildcats - bobcats, mountain lion, lynx - hence the nickname.

Another popular alternative story tells of bills including wildcats as part of the imagery printed on them. Remaining Michigan tender from this period doesn’t offer many examples to corroborate this theory, but the historic bills still in existence fall short of covering every denomination and bank.

The Schemes

Setting up banks in distant locales was far from the only trick played by swindlers. By the end of the law’s first year, it was clear that something needed to be done to reign in the excess of new, insecure currency. Each bank in the state was to be visited at least once every three months by one of the three bank commissioners appointed on December 30, 1837. They were tasked with checking that banks held proper reserves of specie, usually held in specie boxes. Elaborate ruses were set up to evade these rules.

“A little specie was made to go a great way in flooding the country with worthless paper,” recounted the Ann Arbor Argus a half century later. Rather than holding an entire box of coins as a reserve, crafty bankers would fill them with scrap iron to approximate their weight and include a thinner layer of specie on top to give the appearance of completeness.

Bankers would work in cahoots to keep up this charade and others. When a commissioner visited, bankers were said to inquire where he would be traveling to next. Once they received an answer they would quickly send the same box of recently verified specie (or, perhaps, fake specie) ahead to the next bank. The most dramatic tales recount the evidence arriving just in the nick of time, being “handed in at the back door of the banking house while an examination was in progress.”

Fraud was taken even further with the invention of fake towns. These fabricated village’s (less than real) real estate holdings were used as security for a bank’s establishment. The Courier lists the example of “Lowell, an imaginary place on the Huron river.” From The Argus, “In Washtenaw county there were towns called Boston, Saratoga, Windham and Sharon, and the plats of them are on record in the register’s office.” However, some of those may have been more real than others. Saratoga was planned by Gardner Lillibridge, who dreamed of creating a town inspired by Saratoga Springs, New York after believing that a mineral water springs was found near Portage Lake. His plans didn't pan out, but appear to have been earnestly erroneous. Sharon Township is still in existence today. Despite evidence of their actuality, their valuations were undoubtedly inflated due to the Westward land speculation bubble, or perhaps they employed the common tactic of creating plat plans that overstated a village's development. "Splendid maps showing contemplated railroads, hotels, mills and large public parks were shown to the would-be investor. High-sounding names were given to the streets and avenues, and the most glowing inducements held out to the stranger, who could not find these mythical places even with a guide and map," according to the Argus.

Counterfeiting was also commonplace in the free banking period. Each bank issued their own unique paper money and with the speed at which banks were being created verification was challenging. Bills were typically only one sided, occasionally including an advertisement on the other side.

Bills' imagery was selected by banks to convey confidence or a sense of community. A list of common motifs included Greek and Roman deities, personifications of values like liberty or justice, famous men (American or not), animals, industrial works including buildings and vehicles, scenery of famous cities, and more.

Printing was outsourced to larger operations, usually on the East Coast. This consolidation meant that motifs were reused, and their repetition facilitated even easier counterfeiting. An example appears in the October 4, 1854 issue of the Detroit Daily Free Press:

“A palpable Fraud. One of the most palpable frauds in banking that ever came under our observation was pointed to us a day or two since. It consists in the fact that the five dollar notes on the Government State Bank AT LAFAYETTE, INDIANA, and the notes of the same denomination on the Government Stock Bank AT ANN ARBOR MICHIGAN, ARE PRINTED UPON THE SAME PLATE, the name of the town and State being changed. The object of this fraud undoubtedly is to give currency in Michigan to the notes of the Indiana bank, the casual observer being likely to readily receive them on the supposition that they are the issue of the Government Stock Bank AT ANN ARBOR; and he would not find out his mistake until he should offer them at bank for deposit, when he would be charged two or three per cent discount on every dollar of them.”

Felch vs. Free Banking

Only four state legislators voted against the original 1837 banking law. Most famous among them was Alpheus Felch of Monroe. His steadfastness contributed to his selection as one of the first three bank commissioners tasked with tamping down wildcat banks in 1838 and 1839. His keen ability to sniff out schemes became legend. No padded specie boxes would get past him when he demanded they be emptied on the floor in order to expose the worthless junk they held. When asked where he would be traveling next, Felch was said to give one location and travel to another, preventing the relay of the same specie from bank to bank.

These stories of Felch’s fortitude against fraud largely stem from his own telling of events, but the proof of his character may be discerned from his career's continual rise. He went on to become a Supreme Court Justice for Michigan, Governor, U.S. Senator, and was appointed by President Franklin Pierce to settle land-claims at the end of the Mexican-American War. Afterward, he returned to Michigan and settled in Ann Arbor in 1856 where he lived until his death in 1896 at the age of 91. He is buried at Forest Hill Cemetery.

His name is enshrined in Ann Arbor with both Felch Street and Felch Park, located in front of the Power Center on the University of Michigan's campus.

End of an Era

Despite wildcat banks emergence from free banking, free banking itself was practiced in other states, including New York and Georgia, without as catastrophic of effects. Reckless Western real estate valuation and the Panic of 1837 both factored into Michigan’s disaster. As a result of the Panic, specie payments were suspended in May of 1837, allowing banks throughout the country to operate without specie redemption at full value. Michigan undoubtedly erred in their policy, but its ill effects were exacerbated by events taking place across America.

The General Banking Law was suspended in 1838 and ultimately declared unconstitutional in 1845 during Felch's tenure on the Michigan Supreme Court, the rambunctious wildcat period a brief, but costly, two years. Estimates of how much money was lost are difficult to calculate since records were commonly inaccurate due to negligence, purposeful or otherwise. Still, those in possession of Michigan notes during the time were estimated to have lost 60 percent of their face value. Greater free banking came to an end in 1865 when the federal government intentionally taxed state bank's notes out of use in favor of national banks.

Use of the term "wildcat" is experiencing a resurgence, being applied to a modern form of banking where currency is "printed" without effective collateral, causing men to once again go to bed rich and wake up penniless: cryptocurrency.

Bank of Washtenaw/Chapin House, 200 N Fourth Ave, Corner of E Ann St, August 31, 2020 Photographer: Steve Jensen

Year:

2020

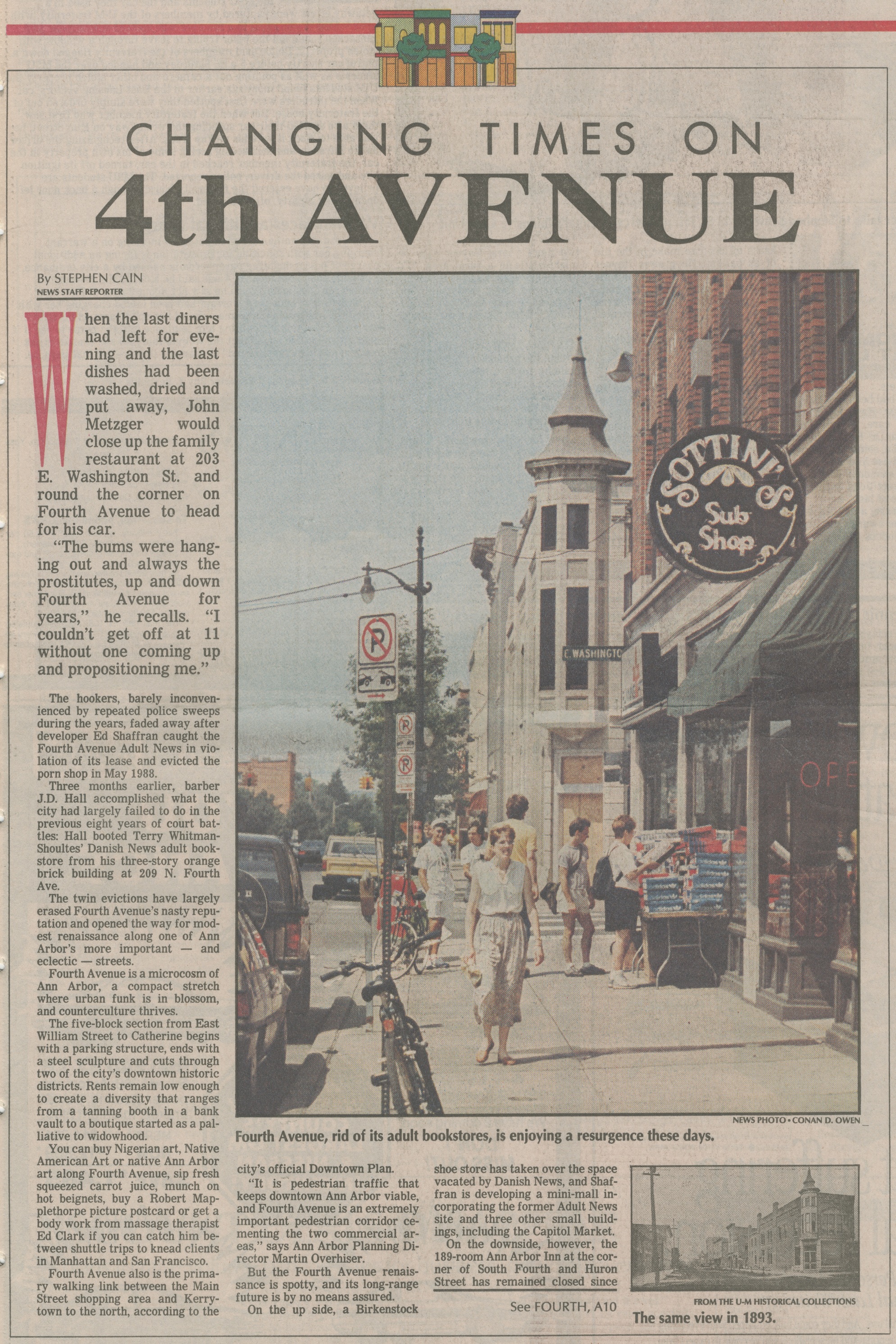

Changing Times On 4th Avenue

- Read more about Changing Times On 4th Avenue

- Log in or register to post comments

Bank of Washtenaw banknotes

- Read more about Bank of Washtenaw banknotes

- Log in or register to post comments

The Chapin House surrounded by large catalpa trees and gardens, ca. 1870

Year:

c.1870

Washtenaw Bank, 1836

Year:

1836

- Read more about Washtenaw Bank, 1836

- Log in or register to post comments

First Bank Started in Ann Arbor 93 Years Ago

- Read more about First Bank Started in Ann Arbor 93 Years Ago

- Log in or register to post comments